TLDR: We just launched AI Search Trends in Scrunch to bring you the clearest view yet of what people are asking LLMs and how your brand shows up.

Here’s what we launched, how it works, and why you should take the insights as guidance, not gospel.👇

If you’re reading this, odds are you’re familiar with the search volume metrics you can find in pretty much every SEO tool.

There's NDAs in place that prevent anyone from sharing exactly where these numbers come from, but a lot of it is based on panel data (i.e., datasets built on information collected from a pool of the same people multiple times over a given time period).

Your SEO tool can’t guarantee that 50,000 people are actually Googling the word “cheeseburger” every month, but, by using panel data, it can extrapolate and estimate.

This data is directionally helpful (depending on the panel sources), but shouldn’t be used for much more than that—as in, we wouldn't suggest forecasting revenue from it.

Same goes for the data we’re surfacing with AI Search Trends: It’s a helpful proxy, not an unimpeachable source of truth.

And any vendor who would tell you otherwise is operating on good vibes and selective memory.

Every marketing, SEO, growth, and content team is clamoring for the same insights, just now for AI search versus traditional search.

They want to know what their ideal customers are asking about, how often, and whether their brands show up in the answers.

We built AI Search Trends—now generally available for all customers (including those who start a 7-day free trial)—to help you do just that.

So let’s dive in.

See what people are asking AI about (and how you stack up)

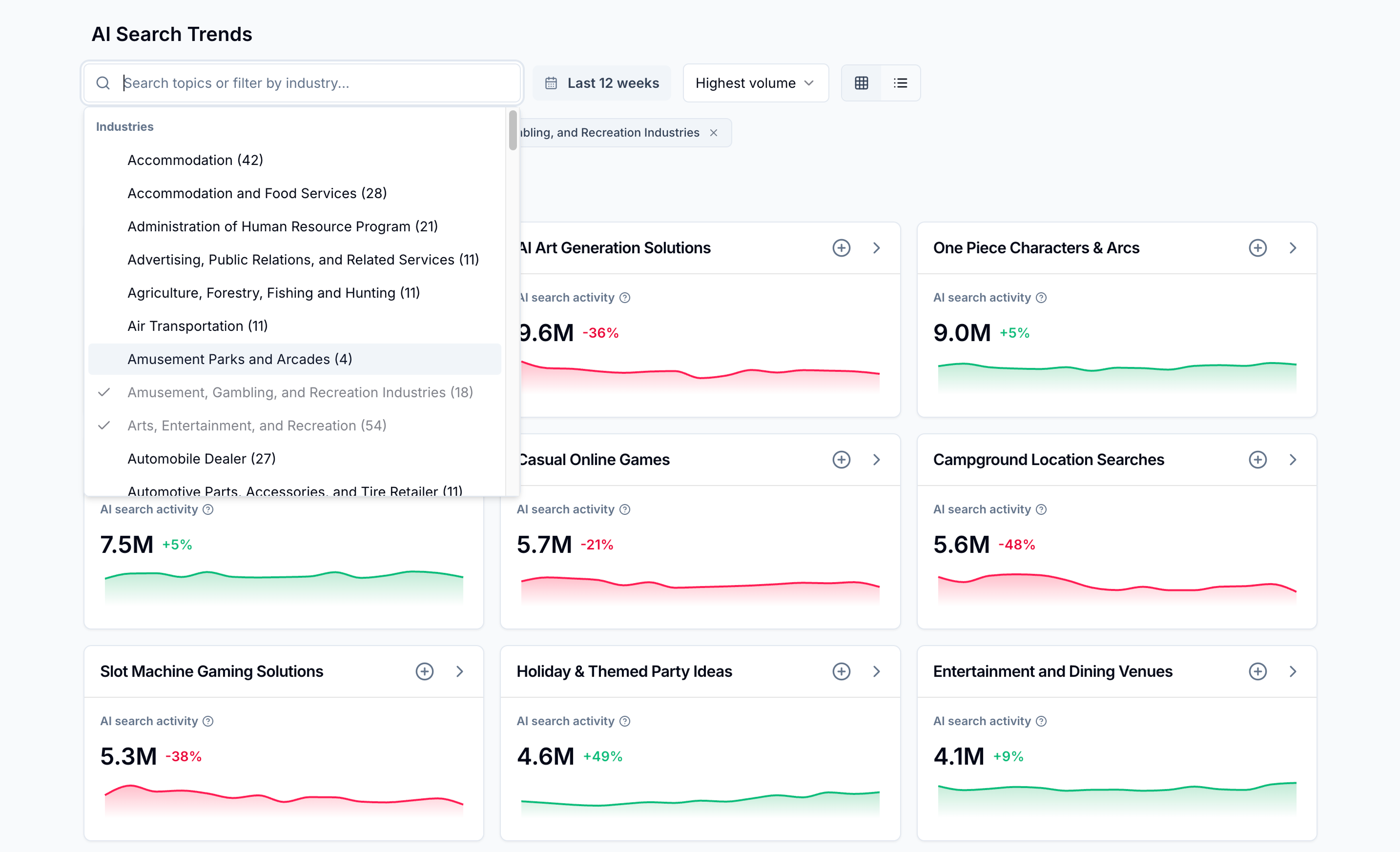

Starting today, Scrunch users will see AI Search Trends in the left sidebar of our platform. Here's how it works.

Topic selection: Start by searching and select the topics that are relevant to your business (or let us do it for you by choosing from our suggested topics which will show when you don't have any selected to start).

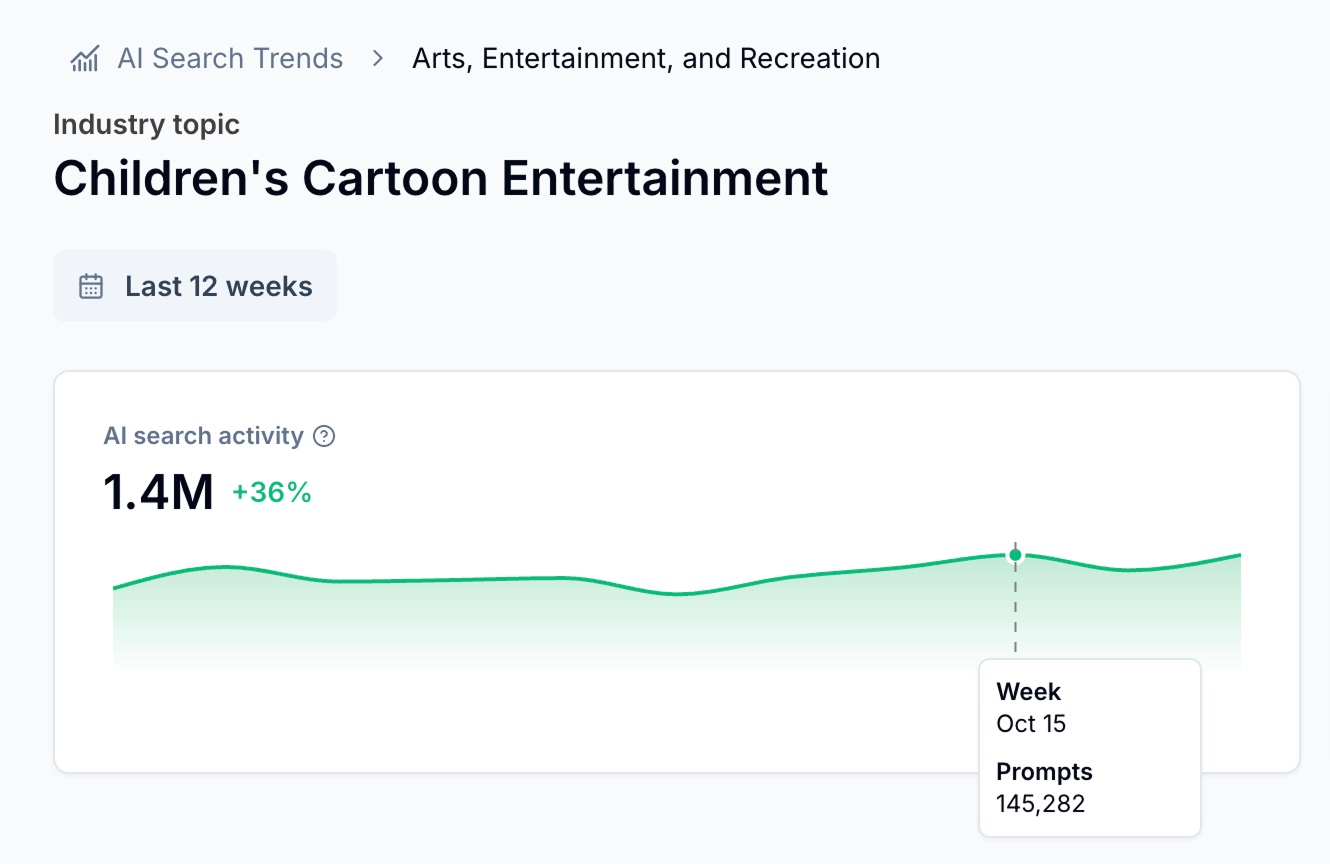

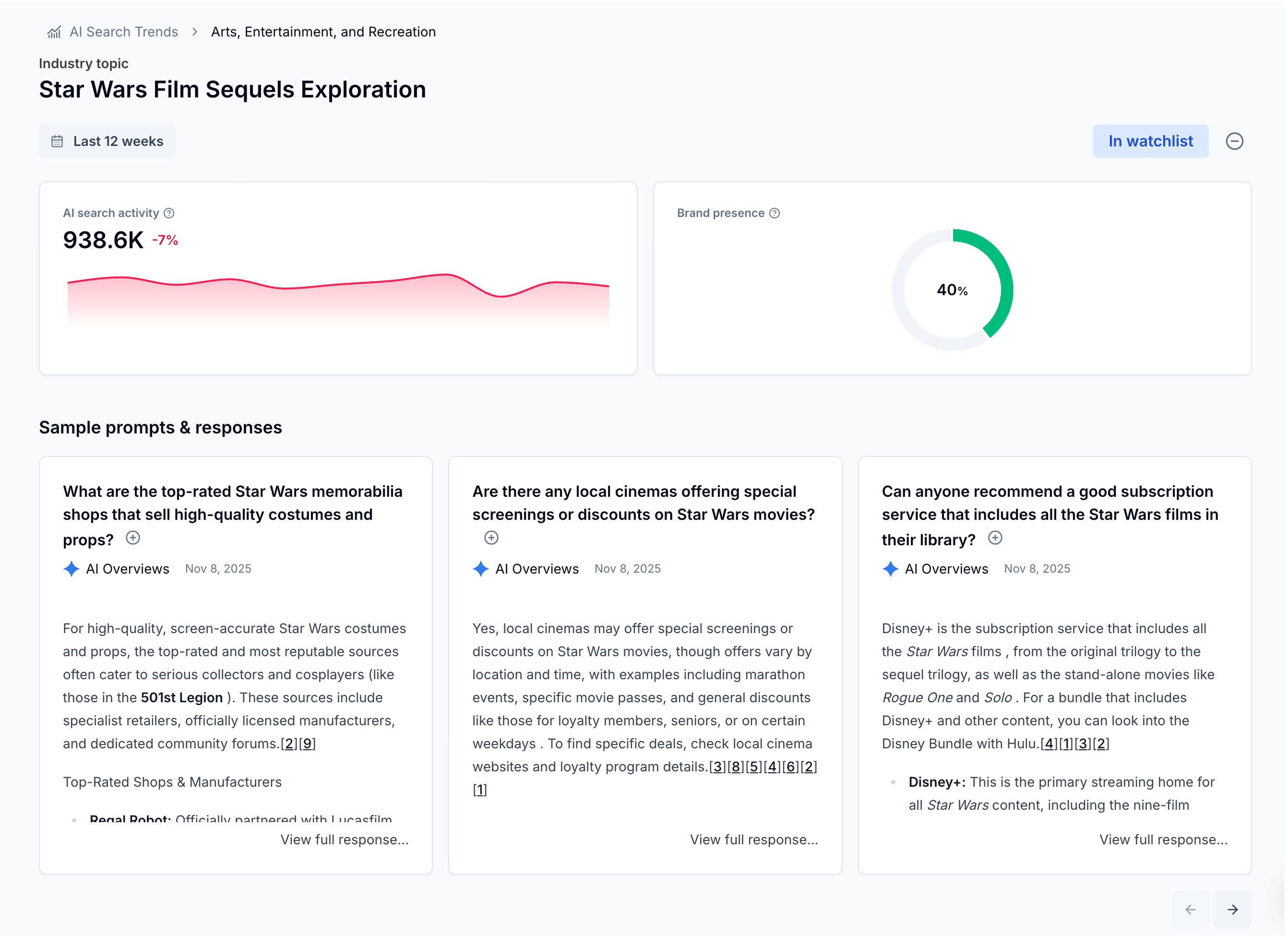

Topic trends & volume: After selecting topics, we show you the estimated prompt volume related to each topic added to your watchlist over your selected timeframe. We'll also surface how topic volume is trending over time as a percentage and as a week-by-week visualization.

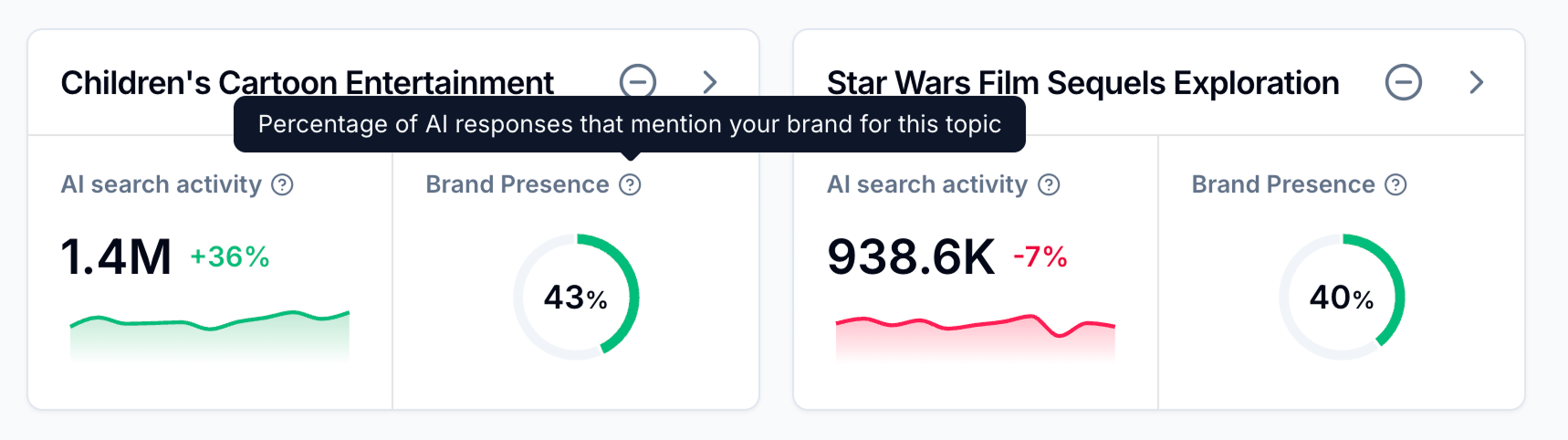

Brand presence: We show you the percentage of AI responses that mention your brand for a certain topic.

This information—how popular a topic is, how your brand shows up for it—can then be used as a proxy for where to focus your efforts.

No matter your industry, it pays to know when potential customers are asking AI about a business-relevant topic.

More to the point, it pays to know how often your brand is mentioned or cited when they do.

Now you can with just a couple of clicks in Scrunch.

Here’s an example of how some of our beta users have been tracking topics with AI Search Trends mapped to industry and personas in Scrunch:

🛫 Air Travel

Target Audience: Affluent Travelers

Topic tracked with AI Search Trends: Airport Lounge Access Services

======

📡 Digital Streaming

Target Audience: Exhausted Parents

Topic tracked with AI Search Trends: Children's Cartoon Entertainment

======

🏦 Financial Services

Target Audience: First Time Homebuyer

Topic tracked with AI Search Trends: Mortgage Lending Services

======

We’ve worked to eliminate any analysis paralysis. Scrunch will automatically recommend topics by mapping what we can infer about your brand (using AI) and tying that to NAICS industry classifications.

You can also search for any topics you want or filter by industry from our database and add them to your watchlist. Once you subscribe to a topic, we’ll immediately start measuring your brand presence for it.

And, we’re just getting started: Today’s release is only V1 of what we have planned for AI Search Trends. Fast follows include competitor presence tracking, sentiment analysis, and self-service for new topic requests (and we ship fast, so expect them this month!).

Now let’s talk about how we got here.

Behind the scenes: How we calculate AI search volume

AI platform operators are the only ones with a complete view of activity on their platforms.

Everyone else—including us—relies on panel data to estimate AI search volume. That's just how the industry works, at least for now.

But not all panel data is created equal.

It’s one of the reasons we kept our analysis at the topic level to start. There’s simply not enough trustable data to make sure anything deeper than that is accurate.

We acquired end-to-end AI search interaction data from high-quality, privacy-compliant, third-party providers. This includes millions of real, complete, consumer-to-AI interactions every month across platforms like ChatGPT, Perplexity, and Google AI Mode.

We only use data where we have high confidence in both the integrity and typicality of the population captured and the completeness of the interaction data.

Every panelist is verified and explicitly consents to data collection (coverage includes the US and UK, with additional global markets coming online).

Typical tracking systems get swamped by long-tail noise: A handful of topics dominate while most barely register. We avoided this by curating 1,500-plus high-signal topics at a consistent granularity, which means cleaner visibility and more confident action.

We started with a dataset of more than 300 million events (including AI prompts, responses, and pageviews in panel), anonymized the data to remove personally identifiable information, and mapped prompts to a collection of curated topics.

Next we time-bucketed the data for stability, benchmarked coverage against external AI-use totals, then de-biased weighted it to improve representativeness. Finally we applied proprietary models to extrapolate population-level estimates, accounting for demographics and consumer-interest signals.

In plain English: We’re confident that we’re producing the best possible interpretation of AI search trends for our customers.

This is what honest AI search data looks like

To be blunt, there’s a lot of bogus data out there.

Datasets built entirely on ChatGPT wrapper usage. Raw panel data with zero statistical methodology applied. "Precise volume estimates" at impossible levels of granularity.

This isn’t that.

We believe the data we’re providing is quite valuable in helping brands decide where to focus their time and resources when it comes to AI search.

At the same time, we care about our customers consuming this data intelligently.

AI search trend data is more compass than GPS. We think it’s important to be upfront about that.

Because at the end of the day, that context helps our customers make smarter decisions about AI search. And that’s what we care about most.

Now it’s your turn to dig into the data and put it to work.

The AI search landscape is evolving fast. We designed AI Search Trends to help you stay a step ahead.

Get started with Scrunch

Start tracking AI search trends. Get in touch to see how you can optimize your brand for the AI-first customer journey or sign up for a free 7-day trial.